For en lekmann så sliter jeg litt med å se at mer likviditet (=billigere kreditt?) vil endre på så mye dersom krisen faktisk er utløst ved at alle slutter å være gode forbrukere. Kanskje i det umiddelbare bildet, men etterhvert kan jo dette bli stygt.

Politikk, religion og samfunn Finanskrisen

- Trådstarter BT

- Startdato

Diskusjonstråd Se tråd i gallerivisning

-

Det endrer ikke på konjunkturen, men det stanser en plutselig kollaps ved at bankene slipper opp for penger og stanser finansiering av bedrifter. Man går ikke konkurs av å gå med underskudd, men av ikke å kunne gjøre opp regninger ved forfall. Hvis bankene ser tomme hvelv vil de begynne å strupe ned kassakreditt, og da er det i gang. Likviditet er oljen i systemet. Sentralbanken er "lender of last resort" og har ansvaret for å hindre at dette skjer. Det er penger til utlån, ikke gratis penger eller "helikopterpenger".

Det som fikk en resesjon og et krakk i 1929 til å bli en langvarig depresjon var at sentralbanken insisterte på å strupe ned pengemengden i nedgangstider. Da gikk bankene konkurs etterhvert som bedrifter og privatpersoner ikke kunne gjøre opp for seg, og det hele ble riktig stygt. Den feilen er det ingen som har tenkt å gjøre igjen.

https://www.cnbc.com/2020/03/12/fed...nding-expand-types-of-security-purchases.html

https://e24.no/boers-og-finans/i/WbAdQk/krisetiltak-fra-norges-bank-det-er-en-unntakstilstandQE to Infinity

Here we go again

Fed Panics: Powell Cuts Rates To Zero, Announces $700BN QE5, Unveils Enhanced Global Swap Lines

https://www.zerohedge.com/markets/f...-700bn-qe5-unveils-enhanced-global-swap-lines- Ble medlem

- 19.09.2014

- Innlegg

- 21.748

- Antall liker

- 14.371

de har i det minste playbooken klar denne gangen, sist måtte de først finne den opp...

Trur du har skoliose i verdsbildet ditt. Har linka til denne før: https://tv.nrk.no/serie/harald-eia-presenterer-saann-er-norge Noko som kunne berike?

Norge er ikke sosialistisk. Norge er sosialdemokratisk; et system som kan fungere tilfredsstillende i korte perioder, gitt en rekke forutsetninger så som en liten og (etnisk, kulturelt og verdimessig) homogen befolkning, høy konformitetsgrad, høy generell tryggetsfølelse, høy grad av skjerming fra omverdenen, liten vilje til selvrealisering, allmenn underdanighet og høy tillit til myndighetene. Dette begynner allerede å knake i fundamentet som følge av bitte litt fremmedkulturell innvandring og en tilgang til inntrykk og meninger fra andre steder i verden som ikke fantes tidligere. Jeg spår for de neste decennier en større grad av konflikter mellom fremmedfiendtlige og innvandrere, en gryende sensur av internett og åpne medier for å skjerme nordmenn fra potensielt destabiliserende inntrykk, en økende grad av livsstilsregulering for å begrense galopperende velferdskostnader, samt en stadig økende grad av politikerforakt og mistillit til lovgivende myndigheter. Dette er en dekadens som har begynt, er irreversibel og vil tilta i stadig sterkere grad. Befolkningen har blitt mindre homogen, mer selvbevisst og mindre skjermet fra omverdenen, altså har forutsetningene begynt å forvitre.Zomby_Woof skrev:Akkurat hva er denne sosialismen du refererer til, Slub?

Tusen slike krakk til, så er amerikanerne nede på vårt nivå?

Eller tusen slike krakk til, så er vi nede på kinesernes nivå?

Sosialisme er noe helt annet, at SV kaller seg "sosialistisk" er landets største politiske bløff. I et sosialistisk system finnes ingen privat eiendomsrett, mens privat eiendomsrett i Norge faktisk er vernet sterkere enn de aller fleste andre steder. I et sosialistisk system er eierskapet over produksjonsmidlene, forvaltningen og som en forlengelse hver enkelts liv og leve, kollektivisert i et flertallets diktatur. I et sosialdemokrati er velferdstilbudene sosialistiske, men verdiskapningen er i høyeste grad kapitalistisk.

Hvis Norge var sosialistisk ville du i skrivende stund rotet i grøftekanten etter ihjelkjørte grevlinger til middag, istedet for å surfe på nettet med en ny PC. Hvis verden var sosialistisk ville grevlingene rotet etter restene av deg.- Ble medlem

- 19.09.2014

- Innlegg

- 21.748

- Antall liker

- 14.371

Og der var futures på S&P 500 limit down (-5%) etter 15 minutters handel i Asia.SSlubbert

Gjest

^^ Hehe, når er det innlegget fra? Jeg har fortsatt store motforestillinger mot at Marx’ økonomiske teorier kan fungere i, eller er så veldig aktuelle for moderne og postindustrielle samfunn, og at de europeiske sosialdemokratene har sine problemer kan man vel også si at stemmer, men det der ser ut som det må være ganske mange år siden jeg skrev.ZZomby_Woof

Gjest

Klikk på den blå pila i det siterte innlegget. 12 år siden.Noe forandrer seg dog aldri... dertil er AP for mulvarped into maktens tinder....

Meanwhile.....

Perfekt eksempel på: Privatizing profits and socializing losses refers to the practice of treating company earnings as the rightful property of shareholders, while losses are treated as a responsibility that society must shoulder. In other words, the profitability of corporations are strictly for the benefit of their shareholders.

https://www.investopedia.com/terms/p/privatizing-profits-and-socializing-losses.asp

Litt samme som Boeing og en mengde andre store selskap i USA. De har i lengre tid lånt billige penger får så å kjøpe tilbake sine egne aksjer. Nå piper de om bailout.. Det er så tragisk det for blitt. Hva med å hente penger i marked isteden, men neida slik gjør man vell ikke

jepp.

Litt samme som Boeing og en mengde andre store selskap i USA. De har i lengre tid lånt billige penger får så å kjøpe tilbake sine egne aksjer. Nå piper de om bailout.. Det er så tragisk det for blitt. Hva med å hente penger i marked isteden, men neida slik gjør man vell ikke

et nylig innlegg i nyt om flyselskapet american

For American Airlines, the nation’s largest airline, the mid to late 2010s were what the Bible calls “years of plenty.”

In 2014, having reduced competition through mergers and raised billions of dollars in new baggage-fee revenue, American began reaching stunning levels of financial success. In 2015, it posted a $7.6 billion profit — compared, for example, to profits of about $500 million in 2007 and less than $250 million in 2006. It would continue to earn billions in profit annually for the rest of the decade. “I don’t think we’re ever going to lose money again,” the company’s chief executive, Doug Parker, said in 2017.

There are plenty of things American could have done with all that money. It could have stored up its cash reserves for a future crisis, knowing that airlines regularly cycle through booms and busts. It might have tried to decisively settle its continuing contract disputes with pilots, flight attendants and mechanics. It might have invested heavily in better service quality to try to repair its longstanding reputation as the worst of the major carriers.

Instead, American blew most of its cash on a stock buyback spree. From 2014 to 2020, in an attempt to increase its earnings per share, American spent more than $15 billion buying back its own stock. It managed, despite the risk of the proverbial rainy day, to shrink its cash reserves. At the same time it was blowing cash on buybacks, American also began to borrow heavily to finance the purchase of new planes and the retrofitting of old planes to pack in more seats. As early as 2017 analysts warned of a risk of default should the economy deteriorate, but American kept borrowing. It has now accumulated a debt of nearly $30 billion, nearly five times the company’s current market value.

[…]

The United States economy needs an airline industry to function. The industry is in that sense not a “normal” industry, but rather what was once called a common carrier or a public utility: a critical infrastructure on which the rest of the economy relies. The major airlines know that unlike a local restaurant, they will never be allowed, collectively, to fail completely. In practice, the public has subsidized the industry by providing de facto insurance against hard times in the form of bailouts or merger approvals. And now here we go again.

We cannot permit American and other airlines to use federal assistance, whether labeled a bailout or not, to weather the coronavirus crisis and then return to business as usual. Before providing any loan relief, tax breaks or cash transfers, we must demand that the airlines change how they treat their customers and employees and make basic changes in industry ownership structure.

https://www.nytimes.com/2020/03/16/opinion/airlines-bailout.html- Ble medlem

- 19.09.2014

- Innlegg

- 21.748

- Antall liker

- 14.371

Det ble skrevet mange spaltemetere om "Gullkortet" i Norge under Finanskrisen og hvordan det var en gavepakke til norske banker fra skattebetalerene. Det som derimot sjelden ble kommunisert var at dette var lån og at pengene ble betalt tilbake med renter ved forfall. Operasjonen sett som en ren finansiell transaksjon var ganske lønnsom for den norske stat. Ingen norsk bank ble tilført egenkapital under finanskrisen.

Den pakken som nå er annonsert, og som det sikkert kommer mer av, er annerledes av natur. Det er i stor grad en de facto overføring av offentlige penger til private virksomheter, ymse organisasjoner og privatpersoner som staten ikke får tilbake i sin helhet - den får selvsagt tilbake en god del i form av skatt og avgiter på konsum osv, men dagpenger til hundretusener av permitterte er ikke et lån som skal betales tilbake. Jeg tipper også en god del av støtten som gis til små og store virksomheter, organisasjoner osv nå fremover vil ha klare tegn til rene overføringer for å holde ting i live. Det er også en ikke ubetydelig støtte i form av at det offentlige ikke ser ut til å permittere noen selv om aktiviteten på mange områder der også går ned pga mindre å gjøre, ansatte som er hjemme med barn osv. Et fenomen man forsåvidt også finner i bedrifter som ikke velger å permittere ansatte - det er tross alt en del av de også (enn så lenge).Litt snø i nordcalifornia om dagen.

Interessant det han sier om Delta:

SSlubbert

Gjest

Ja, en forutsetning for krisehjelp bør være at firmaer ikke bruker av sin egenkapital til å betale utbytte, helt klart. Aker har vel ikke bedt om krisehjelp og har god likviditet tross coronakrisen, men det er jo en balansegang det der med utbytte. For hvis et firma betaler så mye i utbytte at likviditeten blir dårlig så vil aksjekursen gå ned, og da blir eierandelene til aksjeeierne mindre verdt. Så å betale alt for mye i utbytte er å skyte seg selv i foten med tanke på fremtidig aksjeverdi.

Dog synes jeg nok at Aker bør droppe utbyttet hvis det ikke alt er vedtatt, fordi det fremstår umusikalsk. Da vil de også være bedre rustet for fremtidige likviditetsproblemer og dertil hørende fall i aksjekursen.- Ble medlem

- 19.09.2014

- Innlegg

- 21.748

- Antall liker

- 14.371

Stort sett alt av utbytter er vedtatt i Norge (skjer stort sett ifm resultatfremleggelse for året før, noe som typisk skjer i februar).Dog synes jeg nok at Aker bør droppe utbyttet hvis det ikke alt er vedtatt, fordi det fremstår umusikalsk. Da vil de også være bedre rustet for fremtidige likviditetsproblemer og dertil hørende fall i aksjekursen.

Gangen er imildertid at det vedtas og settes to datoer:

- En dato hvor akskjen handles ex utbytte, dvs at for å faktisk få utbytte må man eie aksjen før denne datoen.

- En dato for faktisk betaling - den er typisk en uke eller to senere.

De langt fleste selskaper har vedtatt, men tipper svært få har handlet ex utbytte og knapt noen har betalt ut noe hittil i år.

Det burde være en selvfølge å revurdere utbytte for 2019 når bedriften i 2020 står i en passe krisesituasjon og veldig ukjent terreng. Og støtter AP, SV og RV: vurderer dere utbytte nå, ikke kom senere å be om økonomisk hjelp.

Ja, en forutsetning for krisehjelp bør være at firmaer ikke bruker av sin egenkapital til å betale utbytte, helt klart. Aker har vel ikke bedt om krisehjelp og har god likviditet tross coronakrisen, men det er jo en balansegang det der med utbytte. For hvis et firma betaler så mye i utbytte at likviditeten blir dårlig så vil aksjekursen gå ned, og da blir eierandelene til aksjeeierne mindre verdt. Så å betale alt for mye i utbytte er å skyte seg selv i foten med tanke på fremtidig aksjeverdi.

Dog synes jeg nok at Aker bør droppe utbyttet hvis det ikke alt er vedtatt, fordi det fremstår umusikalsk. Da vil de også være bedre rustet for fremtidige likviditetsproblemer og dertil hørende fall i aksjekursen.

De eneste som fortsatt kan betale utbytte samt store bonuser til sjefene, er bankene. De er jo "fredet" av myndighetene og blir ikke slått konkurs. RV's leder hadde jo et syrlig stikk til bankene som en parantes i ei setning, her forleden på den pressekonferansen med krisepakkene fra myndighetene.Typisk foreslår administrasjonen et utbytte ovenfor styret, som gir sin tilslutning eller endrer forslaget. Styret fremmer sin innstilling til generalforsamlingen som beslutter et utbytte. Det vil bli en hel del juss i om styre eller administrasjon kan la være å utføre et slikt vedtak uten å risikere å bli personlig saksøkt for en milliard dollars av en eller annen aksjonær, spesielt hvis selskapet også er notert ved utenlandske børser. Det er også strenge regler og tidsfrister for å kalle inn til ekstraordinær generalforsamling for å endre et slikt vedtak. Det er nok litt hektisk i juridisk avdeling rundt om.

I en situasjon som dette vil jeg tro at administrasjonen gjerne vil beholde pengene i selskapet, mens aksjonærene vil ha cash nå.Sist redigert:som det står i dagbladartikkelen:

«Det kan til og med hende de ombestemmer seg når utbyttet skal bankes gjennom på selskapets generalforsamling 27. april.»

vi får se…- Ble medlem

- 19.09.2014

- Innlegg

- 21.748

- Antall liker

- 14.371

Ja, den helt formelle gangen er nok at det annonseres ifm resultatfremleggelsen og så bankes det gjennom på en generalforsamling (som er de som må vedta det, styret foreslår et utbytte). Sånn sett er det neppe formelt vedtatt mange steder ennå.som det står i dagbladartikkelen:

«Det kan til og med hende de ombestemmer seg når utbyttet skal bankes gjennom på selskapets generalforsamling 27. april.»

vi får se…en ganske fin artikkel om problematikken rundt de kommende «støttetiltak» der over dammen:

Let the bailouts begin

kommentarfeltet er, for å si det mildt, ikke akkurat overbegeistret for holdningene blant big money selskapene. ikke ofte at en en ser amerikanske lesere foreslå nasjonaliseringer i den blekka.Italia nasjonaliserte Alitalia i formiddag.Skulle vel vært postet under Korona.... men passer vel greit nok her og...

Betraktet via min enøyde dorullkjernekikkert - ca 75cm lang, om en tar utgangspunkt i trykkokereffekten fra vintersportsstedene i talia og østerrich... behøver man vel ikke å være hverken prosessor eller rackertforsker for å forstå konskvensene om ikke drastiske tiltak gjennomføres. I en 50km sirkel med episenter i Manchester bor det fler mennesker enn i hele Norden samlet.Sist redigert:

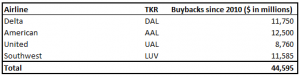

Amerikanske flyselskap har brukt 45 milliarder dollar på tilbakekjøp av aksjer, nå ber de om 50 milliarder dollar i statsstøtte...

jepp.

Litt samme som Boeing og en mengde andre store selskap i USA. De har i lengre tid lånt billige penger får så å kjøpe tilbake sine egne aksjer. Nå piper de om bailout.. Det er så tragisk det for blitt. Hva med å hente penger i marked isteden, men neida slik gjør man vell ikke

et nylig innlegg i nyt om flyselskapet american

For American Airlines, the nation’s largest airline, the mid to late 2010s were what the Bible calls “years of plenty.”

In 2014, having reduced competition through mergers and raised billions of dollars in new baggage-fee revenue, American began reaching stunning levels of financial success. In 2015, it posted a $7.6 billion profit — compared, for example, to profits of about $500 million in 2007 and less than $250 million in 2006. It would continue to earn billions in profit annually for the rest of the decade. “I don’t think we’re ever going to lose money again,” the company’s chief executive, Doug Parker, said in 2017.

There are plenty of things American could have done with all that money. It could have stored up its cash reserves for a future crisis, knowing that airlines regularly cycle through booms and busts. It might have tried to decisively settle its continuing contract disputes with pilots, flight attendants and mechanics. It might have invested heavily in better service quality to try to repair its longstanding reputation as the worst of the major carriers.

Instead, American blew most of its cash on a stock buyback spree. From 2014 to 2020, in an attempt to increase its earnings per share, American spent more than $15 billion buying back its own stock. It managed, despite the risk of the proverbial rainy day, to shrink its cash reserves. At the same time it was blowing cash on buybacks, American also began to borrow heavily to finance the purchase of new planes and the retrofitting of old planes to pack in more seats. As early as 2017 analysts warned of a risk of default should the economy deteriorate, but American kept borrowing. It has now accumulated a debt of nearly $30 billion, nearly five times the company’s current market value.

[…]

The United States economy needs an airline industry to function. The industry is in that sense not a “normal” industry, but rather what was once called a common carrier or a public utility: a critical infrastructure on which the rest of the economy relies. The major airlines know that unlike a local restaurant, they will never be allowed, collectively, to fail completely. In practice, the public has subsidized the industry by providing de facto insurance against hard times in the form of bailouts or merger approvals. And now here we go again.

We cannot permit American and other airlines to use federal assistance, whether labeled a bailout or not, to weather the coronavirus crisis and then return to business as usual. Before providing any loan relief, tax breaks or cash transfers, we must demand that the airlines change how they treat their customers and employees and make basic changes in industry ownership structure.

https://www.nytimes.com/2020/03/16/opinion/airlines-bailout.html

https://edition.cnn.com/2020/03/16/business/us-airlines-federal-bailout/index.htmlVedlegg

-

2.9 KB Visninger: 108

- Ble medlem

- 19.09.2014

- Innlegg

- 21.748

- Antall liker

- 14.371

Husk på at tilbakekjøp av aksjer strengt tatt er et substitutt for utbytte - som er helt normalt at selskaper betaler ut. Norske selskaper betaler mye mer utbytte enn amerikanske målt i prosent. Tilbakekjøp fremfor utbytte er ofte skattemessig gunsting for investorer (utsatt skatt på kapitalinntekter fremfor løpende skattlegging av utbytter og skatt på utbytte i USA er ganske høy). I tillegg til dette kommer at boosting av aksjekursen - som er hva tilbakekjøp medfører - har en heldig effekt på ledelsens rause insentivbaserte belønningssystemer som har tatt fullstendig av i USA.

At selskaper hoarder cash gir ganske lite mening - enten investerer de i noe de mener er lønnsomt (Amazon er stjerneksempelet - de har aldri betalt utbytte og ikke kjøpt tilbake aksjer de siste 30 kvartalene, de investerer massivt), eller så betaler de ut en andel til eierene eller så kjøper de tilbake egne aksjer. Det er ingen åpenbar grunn til at et selskap skal sitte på et tårn av cash som gir et sted mellom negativ avkastning (i EUR-land) eller kun 1-2% avkastning (USA). Investorene i selskapet har som regel mer lukrative alternativer å putte de.

For den som måtte tro at tilbakekjøp og fete utbyttebetalinger er noe bare slemme amerikanere driver med så er det veldig få selskaper som betaler ut en større del av overskuddet enn norske sparebanker. De tjener ok med penger, men har lite vekstmuligheter i sine respektive lokale markeder så da betaler de ut ganske rause utbytter. Typisk i størrelsesorden 6-8%. Noen som synest at Sparebanken Øst eller Melhus Sparebank er turbokapitalister? De har en utbytteavkastning på rundt 8% - noe som er fire ganger så høyt som snittet for selskaper i S&P 500 - indeksen, de ligger på rundt 2% i direkteavkastning men er hissige på å kjøpe tilbake egne aksjer.

Bottom line: Pengene hadde gått ut av selskapet på en eller annen måte uansett med mindre de har noe spennende å investere i. Det gjør amerikanske selskaper i stadig mindre grad. Det er ingen som vil eie aksjer fordi selskapene de eier har et tårn av penger som gir nesten 0 avkastning.Sist redigert:De har jo tappet selskapene for 45 milliarder i egenkapital som de nå hadde hatt bruk for. Kom ikke å si at det er gunstig eller smart business. Utrolig hvor langt ut på landet denne gjeldsbobla har dervet samfunnet vårt.Greia i USA er at de har fått massive skattelette der argumentet har vært at de skaper arbeidsplasser. Skattelettene har gått til kjøp av egne aksjer og dermed rett i lomma på eierne.

Selskaper i Norge følger også med på den trenden.- Ble medlem

- 19.09.2014

- Innlegg

- 21.748

- Antall liker

- 14.371

Synest du det er smart business å ha 45 milliarder dollar investert i f.eks kortsiktig amerikansk statsgjeld med en avkastning på 1-2% ? Cash is king når man virkelig trenger det som er en gang hvert 10. år eller så. Gjeld er også dødlig med ujevne mellomrom (en av grunnene til at warren buffet hater gjeld). Det er ikke særlig med kapitalkrav til selskaper utenom banker som etter finanskrisen er regulert veldig tungt. De har veldig mye egenkapital nå og derfor er p.t. ikke Finanstilsynet særlig bekymret for norske banker i denne omgang. Jeg skal stille meg langt frem i køen for folk som mener at mange selskaper har altfor mye gjeld, men jeg ser ingen spesiell grunn til at amerikanske flyselskaper skal sitte på 45 milliarder dollar i cash for noe som inntreffer med tiårs mellomrom. At reiseaktivitet faller til noe nær 0 har vel aldri skjedd så lenge sivil luftfart har eksistert. Synest du Birkebeinerrennet, Rockefeller, frisørsalonger eller puber burde ha en krigskasse for å ta høyde for at besøket faller til 0 omtrent over natten og alle inntekter er borte i ukesvis mens kostnadene løper?De har jo tappet selskapene for 45 milliarder i egenkapital som de nå hadde hatt bruk for. Kom ikke å si at det er gunstig eller smart business. Utrolig hvor langt ut på landet denne gjeldsbobla har dervet samfunnet vårt.

En vanlig norsk nordmann låner et sted rundt 85% for å kjøpe seg en bolig. Så er de permitterte over natten pga et virus. De må også bailes ut av staten for alle praktiske formål - de fleste har ikke likviditet til å klare seg uten inntekt i noen måneder mens alle faste kostnader løper. Det er mye gøyere å reise på fotballtur til London enn det er å spare opp et greit buffer for en regnfull dag.Pengene går til utbytte, og puming av akjekurs. Ny investeringer blir belånt isteden for å dra på egenkapitalen. Det er denne runddansen jeg mener er dårlig business. Det hadde vell heller ikke vært dumt å ha 45 milliarder i amerikansk statsgjeld de siste 10 år..GGjestemedlem

Gjest

Som alltid kaster venstrevridde populister seg på enhver anledning totalt uten kritisk sans hvis noe kan brukes i propagandaøyemed. Om det er riktig eller løgn driter de tynt i som alltid.

Nok en gang er ikke virkeligheten helt slik de prøver å få folk til å tro..

---

DN skaper inntrykk av at Aker-sjefen ber om statlig krisehjelp med den ene hånden og deler ut utbytte med den andre. Det er en konstruert kobling, skriver NHO-sjef Ole Erik Almlid.

https://www.dn.no/innlegg/nho/forsv...adeling-og-innovasjon-under-krisen/2-1-775325

Overskrift skaper et misvisende bilde

DNs overskrift i nettutgaven mandag 16. mars, «Aker-sjefen ber om statlig krisehjelp – deler samtidig ut 1,7 milliarder kroner i utbytte», skaper et misvisende bilde.

Brevet fra konsernsjef Øyvind Eriksen i Aker asa er skrevet til meg som leder av NHO. Det var jeg som spurte om Eriksen ville å komme med forslag til prioriterte og nødvendige tiltak for å berge arbeidsplasser og opprettholde aktivitet på norsk sokkel. Jeg setter stor pris på de konkrete og gode forslagene han har kommet med. Blant våre medlemsbedrifter har vi fått mange positive tilbakemeldinger på forslagene fra Akers konsernsjef på vegne av olje- og leverandørindustrien.

DNs misvisende bilde er at det skapes inntrykk av at Aker-sjefen ber om statlig krisehjelp med den ene hånden og deler ut utbytte med den andre. Det er en konstruert kobling. Aker asa har ikke bedt om en krone i statlig krisehjelp. Styret i selskapet foreslo i februar et utbytte for regnskapsåret 2019. Eriksen har foreslått konkrete tiltak som kan utgjøre en forskjell for at norske leverandørbedrifter og norsk oljeproduksjon kan komme gjennom denne krisen på en mest mulig måte.

Aker asa er en aktiv eier som utvikler norsk industri. Norsk næringsliv trenger flere private eier som Aker asa.Det samme kan det være nå er vi på NULL, og jukset er i ferd med å vise seg.- Ble medlem

- 19.09.2014

- Innlegg

- 21.748

- Antall liker

- 14.371

utbytte og tilbakekjøp er to sider av samme sakPengene går til utbytte, og puming av akjekurs. Ny investeringer blir belånt isteden for å dra på egenkapitalen. Det er denne runddansen jeg mener er dårlig business. Det hadde vell heller ikke vært dumt å ha 45 milliarder i amerikansk statsgjeld de siste 10 år..

amerikanske selskaper investerer ganske lite - men det er populært å låne billig for å kjøpt tilbake aksjer

å eie masse amerikansk statsgjeld de siste 10 år kunne vært veldig lønnsomt om man hadde eid lang løpetid, svært lite lønnsomt med kort løpetid.

Jeg sliter bare med at (fly)selskaper skal planlegge for noe som virkelig aldri har inntruffet før. For bankvesenet så vet man at nedturer kommer innimellom og da må de være robuste nok til å tåle økende tap på utlån. Det er de stort sett nå, de var det i betydelig mindre grad i 2008.

Synest du at Birken burde ha cash til å betale alle leverandører selvom rennet blir avlyst? Synest du rockefeller bør ta høyde for at alle konserter er kansellert på ubestemt tid? Burde SATS ha penger for å håndtere at staten i praksis forbyr besøk på treningssentere? Synest du at en gjennomsnittelig nordmann burde ta høyde for at han/hun plutselig står uten inntekt over natten nesten helt ut av det blå pga noe som sist skjedde i 1919 eller når det var?

Om du svarer ja på alle de spørsmålene så er resonnementet ditt i det minste konsistent, men jeg tviler på at du gjør det. Som sagt synest jeg at ting har gått relativt langt av skaftet på mange områder i amerikansk business, men at de burde ta høyde for noe som dette er ganske drøyt. Hvor lenge burde et flyselskap i tilfelle være i stand til å betale lønn, leie av alt mulig, renter på gjeld osv omtrent uten å ha inntekter? Er det en større moralsk feil at et selskap har 85% gjeld enn at en privatperson har det samme for å kjøpe seg en "sikker investering" i egen bolig? Norske husholdninger er blant de mest forgjeldede i verden.Poenget mitt er bare at de kommer skrikende om statsstøtte. Hadde de fått gå konk så hadde jeg ikke bryd meg noe som helst. Det er To Big To Fail jeg vil til livs.Så vidt jeg kan se har norske husholdninger allerede begynt å skrike om statsstøtte, de også. Rentekutt, permitteringsordninger, etc. Blir ikke logikken den samme? Når de har vært så dumme å låne til langt over pipa i den tro at jobbene var sikre, rentene lave og boligprisene bare ville stige så er det deres problem? Burde de ikke bare ta konsekvensene av egen risiko og gå konk? Eller er det et samfunnsansvar å sosialisere den risikoen mens fortjenesten på økende boligpris skal være privat? Noen av oss så hva som skjedde med husholdningene og bankene da en boligboble sprakk tidlig på 90-tallet. Samme adferd, samme vurdering - «too big to fail».Sist redigert:

Ja, men systemet vi alle er en del av krever at vi har handlet på den måten vi har gjort. Økonomisk vekst og inflasjonsmål har vært en hellig gral for det økonomiske systemet vi er en del av. Sentralbanken har i nyere tid slitt med å nå inflasjonsmålet på 2%. Og fortsatt gjelder det at økt etterspørsel gir knapphet på varer, og knapphet på varer gir økte priser? Og motsatt; økt sparing og liten kjøpelyst gir arbeidsledighet og mulig deflasjon?Så vidt jeg kan se har norske husholdninger allerede begynt å skrike om statsstøtte, de også. Rentekutt, permitteringsordninger, etc. Blir ikke logikken den samme? Når de har vært så dumme å låne til langt over pipa i den tro at jobbene var sikre og boligprisene bare ville stige så er det deres problem? Burde de ikke bare ta konsekvenseneav egen risiko og gå konk? Eller er det et samfunnsansvar å sosialisere den risikoen mens fortjenesten på økende boligpris skal være privat? Noen av oss så hva som skjedde med husholdningene og bankene da en boligboble sprakk tidlig på 90-tallet. Samme adferd, samme vurdering - «too big to fail».

Kanskje det er noe feil med hele systemet vi alle er en del av?

Forresten, nå innfører USA borgerlønn og flere økonomer her hjemme ønsker tilsvarende. Hva mener du om det?GGjestemedlem

Gjest

Rentene er allerede så lave at om de blir kuttet vil det ikke utgjøre den helt store forskjellen for husholdninger når det kommer til huslån i det minste. Men om man sliter økonomisk eller kommer til å gjøre det i nær fremtid kan det være en tanke å snakke med banken om avdragsfrihet et år eller mer. Noen banker lar deg gjøre dette helt automatisk bare ved å logge deg på og endre innstillingene til lånet. Det kan fort bety mer enn halvering av utgiftene til lånet hver måned, spesielt stort er utslaget om man er tidlig i nedbetalingsplanen hvor avdraget kanskje utgjør 60% av den månedlige summen.Så vidt jeg kan se har norske husholdninger allerede begynt å skrike om statsstøtte, de også. Rentekutt, permitteringsordninger, etc. Blir ikke logikken den samme? Når de har vært så dumme å låne til langt over pipa i den tro at jobbene var sikre og boligprisene bare ville stige så er det deres problem? Burde de ikke bare ta konsekvenseneav egen risiko og gå konk? Eller er det et samfunnsansvar å sosialisere den risikoen mens fortjenesten på økende boligpris skal være privat? Noen av oss så hva som skjedde med husholdningene og bankene da en boligboble sprakk tidlig på 90-tallet. Samme adferd, samme vurdering - «too big to fail».- Ble medlem

- 19.09.2014

- Innlegg

- 21.748

- Antall liker

- 14.371

Presis.Too much bolig to fail ?Så vidt jeg kan se har norske husholdninger allerede begynt å skrike om statsstøtte, de også. Rentekutt, permitteringsordninger, etc. Blir ikke logikken den samme? Når de har vært så dumme å låne til langt over pipa i den tro at jobbene var sikre og boligprisene bare ville stige så er det deres problem? Burde de ikke bare ta konsekvenseneav egen risiko og gå konk? Eller er det et samfunnsansvar å sosialisere den risikoen mens fortjenesten på økende boligpris skal være privat? Noen av oss så hva som skjedde med husholdningene og bankene da en boligboble sprakk tidlig på 90-tallet. Samme adferd, samme vurdering - «too big to fail».Tror folk undervurderer hvor lite penger man kan leve på. Bare man slipper å betale avdrag og kun renter går det bra. Hadde ikke oppdrag i 3 månender i 2016 og det så ille ut. Nettopp bygd nytt hus med mye gjeld... utbetaling ifra NAV 19k. Satte bremsen på. Utrolig hvor mye man klarte å redusere forbruket. Ble sjokkert igrunn. Sa opp alt av unødvendige ting etc. Nøye med matinnkjøp etc. Det går nok bra hvis man vil- Ble medlem

- 19.09.2014

- Innlegg

- 21.748

- Antall liker

- 14.371

Nå er det uansett ikke annet å bruke penger på enn faste utgifter og mat stort sett. Så forbruket blir automatisk drastisk redusert for mange, spesielt om en del offentlige utgifter fryses (de har sagt de skal fryse SFO/AKS så vidt jeg vet og kanskje kommer det mer etter hvert).Tror folk undervurderer hvor lite penger man kan leve på. Bare man slipper å betale avdrag og kun renter går det bra. Hadde ikke oppdrag i 3 månender i 2016 og det så ille ut. Nettopp bygd nytt hus med mye gjeld... utbetaling ifra NAV 19k. Satte bremsen på. Utrolig hvor mye man klarte å redusere forbruket. Ble sjokkert igrunn. Sa opp alt av unødvendige ting etc. Nøye med matinnkjøp etc. Det går nok bra hvis man vil -

Laster inn…

Diskusjonstråd Se tråd i gallerivisning

-

-

Laster inn…