Obligasjonene ble omsatt i annenhåndsmarkedet med skyhøy yield på over 30 %. Et rent veddemål, men det var fullt mulig å kjøpe gjeldspapirer til konkurspris og få en trivelig "effektiv rente" på dem. Det var en veldig liten del av gjelden som ble omsatt på den måten, så det er ikke opplagt for meg heller at de store långiverne som Deutsche Bank tjente noe på miséren. Kanskje noen kan utdype det?Ta høy nok rente? I auksjoner sv statsgjeld er renten og følgelig yielden gitt. Gresk statsgjeld har - sett i ettertid, hatt komisk lav rente. Type tysk stat + altfor lite.

Statsgjeld er ikke slik at man snakker med ulike banker og fisker hvor man kan låne billigst. Det er offentlige auksjoner og det aller, aller meste er kjent på forhånd.

I et scenarie der man nedskrevet lånet med ca halvparten, forlenger løpetiden og senker renten tjener man ikke på det. Europeiske banker har tatt tap på ca 100 milliarder euro på gresk statsgjeld så jeg lurer fortsatt på hvordan banker har tjent på denne operasjonen. Kanskje hardingfele kan forklare?

Hellas i "deep shit"

- Trådstarter Bjørn.H

- Startdato

Diskusjonstråd Se tråd i gallerivisning

-

- Ble medlem

- 19.09.2014

- Innlegg

- 23.414

- Antall liker

- 16.300

Annenhåndsomsetningen var, som du nevner svært lav. Om man kjøpte helt på bunn og solgte helt på topp hadde man hatt ca syvgangeren på kursen. Det var hyggelig for de som gjorde det selvsagt, men det var neppe mange. Tror du skal lete ganske godt, og utenfor Europa, for å finne en bank som har tjent stort på gresk statsgjeld. Europeiske banker kjøpte gresk stat i stor skala før det smalt siden holdningen var at det var statsgjeld i euro så konkurs var ikke et tema og renten var litt høyere enn på papirene til de mer solide statene. Det funket som sikkerheten for deponering i ECB og alt var fint. I børjan var renten type 0.2-0.5 prosentpoeng over de tyske statsrentene. Det gikk jo også rimelig greit i mange år. Men slike saker gjør gjerne det helt til det plutselig inne gjør det lengre. Det er selvsagt lett å si i ettertid at banker og andre burde skjønt tegningen, men etterpåklokskap er enkelt.

Største kjøper av gresk gjeld de siste årene har, med enorm margin, vært den europeiske sentralbanken.Sist redigert:HHardingfele

Gjest

Nye politiske parti i Europa har vist seg å kjapt bli veldig populære, dersom de angriper EU, euroen, bankstyrte nasjoner, osv.

Det gjelder også i Italia, der Beppe Grillo på få år har klart å få sitt parti til å bli landets nest største. Nå mener han Italia må forberede en Plan B, og være klare til å bruke landets gjeld mot Tyskland, før tyskerne angriper. Han vil ha nasjonalisering av bankene og landet vekk fra euro.

Beppe Grillo calls for nationalisation of Italian banks and exit from euro | World news | The Guardian^ hvilket illustrerer hvorfor grekerne fikk lov til å være et eksempel til skrekk og advarsel for likesinnede, som Beppo Grillo og velgerne hans.

Siden du ikke ser ut til å være veldig interessert i å si noe om hva som bør gjøres, men bare kritisere alt og alle som er/tar feil, kan jeg godt fortelle deg hva EU bør gjøre nå. Enkel observasjon: Euroen fungerer ikke som den burde, fordi land med ulik økonomisk situasjon er bundet til å ha samme pengepolitikk (valutakurs og rente).

Vel, det er bare to måter å løse det på. Enten ved å oppløse den felles valutaen og gjeninnføre nasjonale valutaer som flyter i forhold til hverandre og med nasjonalt satte renter, eller ved å utvikle finanspolitiske mekanismer som kompenserer for dette gjennom felles budsjettstyring. Den første løsningen kan du se langt etter (muligens med et unntak for Hellas), så den eneste reellt farbare veien er gjennom en sterkere felles finanspolitikk. Den må kompensere for ulikheter mellom medlemslandene, helst like "automatisk" som en flytende valutakurs vil gjøre det, og den må hindre at enkeltland fører en finanspolitikk som er like skrullete som den Hellas holdt på med i 2001-9. Det betyr både store "automatiske" overføringer fra land som Tyskland til land som Hellas, så store at de blir en merkbar demping av tysk konkurransevne relativt til den greske, og det betyr en tung EU-hånd på rattet i de enkelte statsbudsjettene. Tilsammen betyr det en omfattende overføring av finanspolitisk suverenitet fra medlemslandene til Brüssel.

Populært og lettsolgt? Neppe. Men det er hva EU bør gjøre. Og, bombe, det er hva EU er i ferd med å gjøre. Som vanlig vil det bli overkomplisert av komiteer som skal få med alle mulige hensyn, pakket inn i en masse ord og akronymer, og det vil bli vannet ut av utallige kompromisser, men det er veien fremover for å få euro-sonen til å fungere bedre og for å unngå en (re)fragmentering drevet av forskjellige populistiske neo-nasjonalistbevegelser. Beppo Grillo vil nok ikke like det heller.

https://en.m.wikipedia.org/wiki/Eco...ans_for_a_Genuine_Economic_and_Monetary_Union

http://ec.europa.eu/priorities/economic-monetary-union/docs/5-presidents-report_en.pdfSist redigert:HHardingfele

Gjest

Bombe og bombe. Dette er da velkjent og bevisst EU-politikk. Dine banale forsøk på å forlange svar fra meg er tåpelige, Asbjørn, spesielt når svaret du leverer er en platityde.

Selv tror jeg på break-up. Det er sterk motstand i ulike land mot å bli fratatt suverenitet i den grad som et felles (føderalt) budsjett vil kreve. Ain't ever the fucking goddamn hell gonna happen.- Ble medlem

- 19.09.2014

- Innlegg

- 23.414

- Antall liker

- 16.300

Da jeg studerte for en god del år siden tok jeg et par gode kurs om EU, mest fordi professoren som hadde de var en legendarisk bra foreleser. Husker en gang han spurte ut om noen kunne svare på spørsmålet "hva er målet med EU" ? De vanlige greiene som fred & sånn ble foreslått som svar, men hans tese var "integration sans cesse" - stadig mer integrasjon. Det forelå, fortsatt i følge vedkommende, ingen definert endestasjon for porsjektet, men EU var blitt et dyr som ruller stadig videre på sitt eget momentum.

Jeg er enig med Hardingfela - det er en svært kald dag i helvete før tyskere går med på å forplikte seg til fremover å sende almisser retning sørover når det er motbakke der. Så langt har det vært presentert som lån til Hellas, underforstått penger som på et tidspiunkt skal betales tilbake. Så skjer neppe, men det ville nok blitt "relativt" upopulært om det ble forsøkt solgt inn som direkte overføringer for å utjevne forskjeller mellom landene.

Det er en viss sannsynlighet for at vi nå har sett starten på slutten for Euroen (og muigens EU) as we know it. Det går muligens en grense for hvor mye suverenitet velgere er villige til å avgi til ansiktsløse teknokrater i Brüssel og omegn. Enn så lenge har velgere flest ligget i koma - det er ganske lav valgteltagelse på EU-valgene og det genererer ikke den helt store entusiasmen, men på ett eller annet tidspunkt får folk flest muligens nok. Da er det nok også på tide å finne frem brunfargen i fargeskrinet osv.

Det sagt, så er det veldig, veldig, veldig grisete om noen på et tidspunkt skulle tre ut av den felles valutaen...

Det å være stor investor i rentemarkedet sammenlignes ofte med å snappe opp tiøringer foran en dampveivals. Fortjenesten er ikke så veldig stor, men når det først smeller blir man klemt helt flat. De store bankene som "tjente" på å låne ut penger til Hellas, tjente nok bare de 0,2-0,3 % over risikofri (dvs tysk) rente. Så smalt det, og bankene måtte nedskrive gjelden med 50-75 %. Da skal du ha innkassert rentedifferansen på 0,2-0,3 % bra lenge for å gå i pluss totalt sett. Du har rett i at det poenget ser ut til å forsvinne litt i den mest populistiske argumentasjonen.Annenhåndsomsetningen var, som du nevner svært lav. Om man kjøpte helt på bunn og solgte helt på topp hadde man hatt ca syvgangeren på kursen. Det var hyggelig for de som gjorde det selvsagt, men det var neppe mange. Tror du skal lete ganske godt, og utenfor Europa, for å finne en bank som har tjent stort på gresk statsgjeld. Europeiske banker kjøpte gresk stat i stor skala før det smalt siden holdningen var at det var statsgjeld i euro så konkurs var ikke et tema og renten var litt høyere enn på papirene til de mer solide statene. Det funket som sikkerheten for deponering i ECB og alt var fint. I børjan var renten type 0.2-0.5 prosentpoeng over de tyske statsrentene. Det gikk jo også rimelig greit i mange år. Men slike saker gjør gjerne det helt til det plutselig inne gjør det lengre. Det er selvsagt lett å si i ettertid at banker og andre burde skjønt tegningen, men etterpåklokskap er enkelt.

http://scholarship.law.duke.edu/cgi/viewcontent.cgi?article=5343&context=faculty_scholarshipSist redigert:

OK. Så hvorfor advarer du mot økte nasjonalistiske spenninger hvis det er den løsningen du selv tror mest på? Det hadde vært mer interessant om du kunne si noe om hva EU burde gjøre, heller enn å gjenta Terje Tyslands gamle refreng.Bombe og bombe. Dette er da velkjent og bevisst EU-politikk. Dine banale forsøk på å forlange svar fra meg er tåpelige, Asbjørn, spesielt når svaret du leverer er en platityde.

Selv tror jeg på break-up. Det er sterk motstand i ulike land mot å bli fratatt suverenitet i den grad som et felles (føderalt) budsjett vil kreve. Ain't ever the fucking goddamn hell gonna happen.

Det var forøvrig dissonansen mellom kritikken av EU som føderalt prosjekt og advarslene mot oppbrytning av EU som fikk meg til å etterspørre din løsning. Det er sikkert enklere å kritisere fra alle kanter på en gang, men det er lettere for oss andre å få tak på hva du står for hvis det er en noenlunde konsistent tanke bak det.Sist redigert:- Ble medlem

- 19.09.2014

- Innlegg

- 23.414

- Antall liker

- 16.300

Jepp. Det er ganske åpenbart at en del av de kildene Hardingfele og andre refererer åpenbart ikke har skjønt et pøkk av hva som faktisk har skjedd her. Jeg venter fortsatt på at noen kan forklare meg hvordan man har tjent penger på å være storinvestor i gresk gjeld når man aldri får tilbake ca halvparten av pengene man hadde lånt ut i utgangspunktet.Det å være stor investor i rentemarkedet sammenlignes ofte med å snappe opp tiøringer foran en dampveivals. Fortjenesten er ikke så veldig stor, men når det først smeller blir man klemt helt flat. De store bankene som "tjente" på å låne ut penger til Hellas, tjente nok bare de 0,2-0,3 % over risikofri (dvs tysk) rente. Så smalt det, og bankene måtte nedskrive gjelden med 50-75 %. Da skal du ha innkassert rentedifferansen på 0,2-0,3 % bra lenge for å gå i pluss totalt sett. Det poenget ser ut til å firsvinne litt i den mest populistiske argumentasjonen.

http://scholarship.law.duke.edu/cgi/viewcontent.cgi?article=5343&context=faculty_scholarship

Hvordan noen kan tro at europeiske finansinstitusjoner (dvs banker/forvaltere/forsikringsselskap osv) har tjent seg søkkrike på å låne ut penger til Hellas i primærmarkedet (for det er faktisk hva de har drevet med) er for meg et mysterium.HHardingfele

Gjest

Andres linker får andre stå for.

Man kan greit forestille seg hva britiske velgere måtte mene om et overnasjonalt, føderalt EU-budsjett som skal tilsidesette britenes. Men det får de jo anledning til å mene noe om i 2017, når de skal ha folkeavstemning om de fortsatt vil være i EU.

EU har 24 offisielle arbeidsspråk. Ain't gonna happen.

Official languages of the EU - European CommissionCcruiser

Gjest

- Ble medlem

- 19.09.2014

- Innlegg

- 23.414

- Antall liker

- 16.300

Så hvilke banker har tjent seg søkkrike på å låne ut masse penger til Hellas?

Les artikkelen Asbjørn linket til (og som også er linket til i saken du postet).

Europabevegelsen har ihvertfall mye interessant å diskutere. Det siste var bare en flyveidé noen overentusiastiske Unge Høyre-politikere hadde for flere år siden. En fordømrade dårlig idé som aldri ble hverken Høyres eller Unge Høyres politikk.Tror Europabevegelsen har det vanskelig for tiden. Forresten, ønsker ikke Høyre at Norge skal innføre Euro?Ccruiser

Gjest

Jeg har aldri sagt at noen som helst har tjent seg søkkrike, har dog kommentert at 100milliarder euro i tap er noe høyt anslag. Er motstander av hele bankbailouten jeg, tapene burde vært mye større.

Det er et generelt problem at markedsmekanismene er for svake i finanssektoren, og at det fører til for stor risikovillighet. Helt enig med deg der. Private gevinster, offentlige tap, sagt på en annen måte. På den annen side er det heller ikke bra at banksjefers risikovillighet skal gå ut over innskytere (i motsetning til investorer). For stor sammenblanding av tradisjonell bankvirksomhet og finansielle investeringer er et av problemene, som heldigvis er relativt avgrenset i Norge. Nullingen av aksjene i DnB på 90-tallet er en lærdom som heldigvis fortsatt sitter i.Jeg har aldri sagt at noen som helst har tjent seg søkkrike, har dog kommentert at 100milliarder euro i tap er noe høyt anslag. Er motstander av hele bankbailouten jeg, tapene burde vært mye større.- Ble medlem

- 19.09.2014

- Innlegg

- 23.414

- Antall liker

- 16.300

I tilfellet Hellas synest jeg nesten det er en viss poetic justice i at deler av tapene blir offentlige siden Hellas i stor grad er et mislykket case skapt av Euroen selv.

Det er, som nevnt heller ikke så fryktelig mye profitt å snakke om for långiverene (les: finansinstitusjoner) her. Man kan alltids - og godt med rette - mene at de burde tatt enda større tap. Men nå er det nasjonale og overnasjonale aktører som er kreditorene til Hellas. Hadde det fortsatt vært private hadde det nok vært en runde til med gjeldssanering for lenge siden.

Så offentlige långivere er gjerne slemmere enn private... Prøv å få gjeldsordning og ettergitt gjeld i form av mva eller ikke betalt skatt til staten her i landet. Å få redusert et forbrukslån er a wall in the park til sammenligning.

Joda, det kommer til å skje. Det vil være en treg og komplisert prosess, men alternativene er uakseptable, så det hele vil bevege seg dithen med snilefart.Andres linker får andre stå for.

Man kan greit forestille seg hva britiske velgere måtte mene om et overnasjonalt, føderalt EU-budsjett som skal tilsidesette britenes. Men det får de jo anledning til å mene noe om i 2017, når de skal ha folkeavstemning om de fortsatt vil være i EU.

EU har 24 offisielle arbeidsspråk. Ain't gonna happen.

Official languages of the EU - European Commission

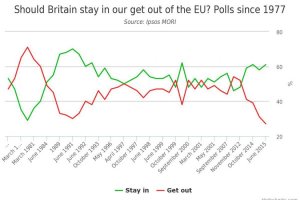

Og UK kommer til å forbli EU-medlem med nokså stort flertall til tross for alt fyrverkeriet de seneste månedene:

The mid-1990s saw the gap between the 'stay in' and 'get out' camps narrow significantly and on occasion "Brexit" has been a more popular option.

Since 2014, however, support for staying in the European Union has once again increased.

Supporting for Britain withdrawing from the EU has fallen to one of its all-time lowest levels.

EU referendum poll tracker and odds - Telegraph

Jeg tror det stemningsskiftet skyldes at britene nå innser at et anti-EU-standpunkt i folkeavstemningen vil få reelle konsekvenser, i stedet for å være et ufarlig utløp for almen brønnpissing og generell misnøye.

Som nevnt tror jeg vi ser situasjonen litt forskjellig. Forklar meg gjerne hvorfor bare 27 % av britene ønsker å forlate EU, hvis alt er så plukkråttent som du hevder. Du vil også få bra odds hos bookmakerne i London hvis du vil vedde pengene dine på at britene takker for seg.Sist redigert:HHardingfele

Gjest

Det hele oppløses lenge før så vil skje, garantert. Fortell meg at EU-landene vil gå med på dette:

Nå tilbyr EU-presidentene en enda mer overnasjonal union | ABC Nyheter

Desperasjon gir dårlige løsninger.

Da kan man like godt foreslå at Tyskland skal tre ut. Langt enklere å gjennomføre, euroen vil bli mer realistisk priset og DM vil få god verdi. Alle blir glade.Ser lovende ut, dette.

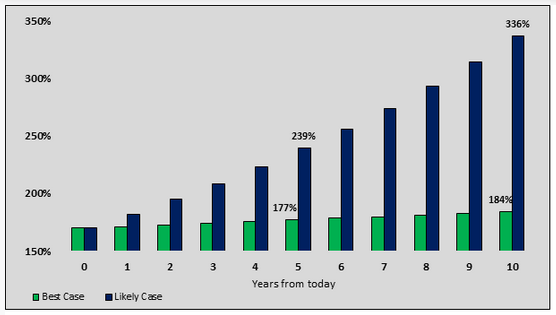

Debt to GDP Scenarios

Michael Lebowitz Blog | The Simple Math Behind Greece’s Complicated Situation | Talkmarkets- Ble medlem

- 19.09.2014

- Innlegg

- 23.414

- Antall liker

- 16.300

Jeg er ganske sikker på at tyske, franske og andre politikere regner pengene de har lånt Hellas som i stor grad tapt, men det kan de selvsagt ikke si høyt.

Forslagene i artikkelen du linker til (som handler om den samme rapporten som jeg la ut en link til i går) er alt annet enn drevet av desperasjon. Jeg mistenker snarere at noen ser nåværende bruduljer som et nødvendig onde for å overbevise folk om at dette er det logiske og nødvendige neste steget - og som du selv sa for et par innlegg siden har det muligens vært planen hele tiden.Det hele oppløses lenge før så vil skje, garantert. Fortell meg at EU-landene vil gå med på dette:

Nå tilbyr EU-presidentene en enda mer overnasjonal union | ABC Nyheter

Desperasjon gir dårlige løsninger.

Da kan man like godt foreslå at Tyskland skal tre ut. Langt enklere å gjennomføre, euroen vil bli mer realistisk priset og DM vil få god verdi. Alle blir glade.

Hvorfor kritiserer du eksakt samme plan som et langsiktig komplott i det ene innlegget og som "desperasjon" i det neste? Det er da jeg begynner å fundere på hva du egentlig mener bør gjøres med dagens EU, siden alt tydeligvis er feil og alle forslag er gale.

Mener du at Tyskland bør melde seg ut av eurosonen og resten fortsette som før, eller at hele greia bør oppløses? Og hvis du mener det er den beste løsningen, hvorfor advarer du da mot nasjonalistiske bevegelser i de forskjellige landene hvis du selv er enig i deres politiske programmer? ???

Jeg mener EU og eurosonen bør utvikles i retning av en mer overnasjonal finansunion for å motvirke de verste utslagene av en felles valuta og felles pengepolitikk i nokså ulike økonomier. Arbeidsmobiliteten og den økonomiske fleksibiliteten er formodentlig god nok, men mangelen på en felles finanspolitikk fører til store skjevheter mellom regioner. Det er løsbart, om ikke populært.Sist redigert:- Ble medlem

- 19.09.2014

- Innlegg

- 23.414

- Antall liker

- 16.300

Arbeidsmibiliteten er ikke god nok. Alt det juridiske og formelle er på plass selvsagt, men pga kulturelle og språklige hindrer får du ikke migrasjon fra sør til nord. Når Hellas og Spania har arbeidsledighet blant på over 20% og den er under halvparten i andre land så skjønner man at den mobiliteten er illusorisk. Uten ferdigheter og med portugisisk som eneste språk man behersker er muligheten for å ta en jobb i Sverige eller Finland et greit estimat for veridien "null"

Det er også et stykke fra premiera divison og milde sommerkvelder til -20 grader, flatfyll og finsk tango.Kanskje, men det er et spørsmål om hvor mye som er nok for at en felles valuta skal kunne fungere. En gumbo-spisende landarbeider fra Louisiana er ikke mye verdt på Manhattan heller selv om språket teoretisk sett er det samme. Deler av USA er i praksis spansktalende (hvis vi snakker om fabrikkarbeidere), noe som også skaper sine forviklinger. Det ser ut til å være godt nok.

Polske og baltiske arbeidere (og svenske kelnere) har ihvertfall ikke noe problem med å røre på seg om det finnes jobber. Jeg har også et inntrykk av at ungdom i mye større grad ser Europa som ett arbeids- og utdanningsmarked. Jeg har en datter som jobber i Spania og en sønn som studerer i Sverige. For dem er det like naturlig som det var å reise inn til nærmeste by for å få en jobb for 30 år siden.Sist redigert:- Ble medlem

- 19.09.2014

- Innlegg

- 23.414

- Antall liker

- 16.300

Selvsagt, men i US of A kommer man svært langt med engelsk eller spansk. EU har ørtenbørten språk, og alle som har møtt unge europeere skjønner ganske kjapt at engelskferdighegene deres er ganske langt under pari i stor grad. En svært stor andel av EUs lønnsmottakere har i praksis eget land som eneste relevante arbeidsmarked.Ja, men igjen er det spørsmål om hvor mange som må være mobile for at det skal være tilstrekkelig. Det er ingen tvil om at antallet svensker, polakker og litauere som jobber i Norge (og drar hjem igjen i nedgangstider) er tilstrekkelig til å gjøre økonomien langt mer fleksibel og motstandsdyktig mot brå endringer enn den ellers ville vært. Kanskje syd-europeere ikke vil reise hit nord, men det behøver de heller ikke. Det er titusener av hardt arbeidende rumenere i de latinske landene som gir lignende virkninger der. Rumensk språk er neo-latin, så de forstår italiensk, spansk og portugisisk uten altfor store problemer.

For argumentets skyld påstår jeg at dette utgjør en tilstrekkelig mobilitet, men at de finanspolitiske virkemidlene mangler. Begrenset mobilitet kan jo også motvirkes med sterkere finanspolitiske virkemidler fra sentralt hold. Det vil også innebære betydelige årlige overføringer fra land som Tyskland til land som Hellas, men innenfor faste rammer heller enn som resultat av krisemaksimering og populistiske folkeavstemninger om ingenting. Dette er ikke noe som løses over natten, men jeg ville ikke veddet mye penger på at EU ikke greier å skape slike mekanismer etterhvert.

Jeg mener altså at det er veien å gå, men er fortsatt spent på å få høre hva Hardingfele mener bør gjøres.Venstrefløyen i Syriza hadde visst store planer:

Slik planla venstrefløyen å ta Hellas tilbake til drakmer - Hellas - Makro og politikk - E24

Hellas åpner for energisamarbeid med Russland - Makro og politikk - E24

Det var jo uheldig for dem at den tiltenkte sponsoren også er blakk:

– Putins valutakasse går tom før 2017 - Makro og politikk - E24HHardingfele

Gjest

Kokkvold med noen betraktninger i Aftenposten:

I sin nåværende form – «one-size-fits-all» – kan ikke valutaunionen fungere før den blir en økonomisk union, og i neste omgang også en politisk union med all reell beslutningsmyndighet overført til Brussel.

Noe de europeiske folkene absolutt ikke ønsker, og som vil være grunnleggende udemokratisk så lenge det ikke finnes noen felles europeisk offentlighet.

Aftenpostens korrespondent Ingrid Brekke siterte nylig den tyske europakjenneren Ulrike Guérot, som har sagt at EU er blitt et slags monster som er ute av stand til å vedta seg frem til det Europa folk ønsker å leve i.

Guérots landsmann Hans Magnus Enzensberger påpekte for tre år siden at Europa allerede en god stund var blitt styrt «ikke av demokratisk legitime institusjoner, men av en rekke forkortelser som har tatt deres plass. Veien videre er det EFSF, ESM, ESB og IMF som bestemmer. Og kun eksperter er i stand til å skrive ut disse akronymene ... Alle disse innretningene har det til felles at de ikke forekommer i noe lands grunnlov, og at ingen velger har noe han eller hun skulle ha sagt»

Per Edgar Kokkvold kommenterer: Euroen har splittet de folk den skulle samle - Aftenposten

Jo, jeg ser at han sier det. Angående det uthevede sitatet: Det er i virkeligheten et flertall av europeerne som støtter en økonomisk union med euroen som eneste valuta, og andelen som støtter dette har økt kraftig de siste to årene:Kokkvold med noen betraktninger i Aftenposten:

I sin nåværende form – «one-size-fits-all» – kan ikke valutaunionen fungere før den blir en økonomisk union, og i neste omgang også en politisk union med all reell beslutningsmyndighet overført til Brussel.

Noe de europeiske folkene absolutt ikke ønsker, og som vil være grunnleggende udemokratisk så lenge det ikke finnes noen felles europeisk offentlighet.

Aftenpostens korrespondent Ingrid Brekke siterte nylig den tyske europakjenneren Ulrike Guérot, som har sagt at EU er blitt et slags monster som er ute av stand til å vedta seg frem til det Europa folk ønsker å leve i.

Guérots landsmann Hans Magnus Enzensberger påpekte for tre år siden at Europa allerede en god stund var blitt styrt «ikke av demokratisk legitime institusjoner, men av en rekke forkortelser som har tatt deres plass. Veien videre er det EFSF, ESM, ESB og IMF som bestemmer. Og kun eksperter er i stand til å skrive ut disse akronymene ... Alle disse innretningene har det til felles at de ikke forekommer i noe lands grunnlov, og at ingen velger har noe han eller hun skulle ha sagt»

Per Edgar Kokkvold kommenterer: Euroen har splittet de folk den skulle samle - Aftenposten

http://ec.europa.eu/public_opinion/archives/eb/eb81/eb81_publ_en.pdf, side 140-141. De nyeste meningsmålingene fra Hellas viste vel at 82 % ønsket å fortsette med euro, altså ytterligere 13 % økt oppslutning siden disse tallene ble innhentet våren 2014.The Standard Eurobarometer survey of autumn 2013 had recorded a slight improvement in the balance of opinion for perceptions of the euro. The momentum of that improvement has continued in this survey: support for the euro (55%) has increased by three percentage points, while opposition to the single currency (36%) has fallen by five percentage points.

The euro balance of opinion has therefore improved by eight percentage points, from +11 in autumn 2013 to +19 today, i.e. its highest level since autumn 2010 (+23), equalling that of spring 2011 and considerably higher than the lowest level, recorded in the Standard Eurobarometer survey of spring 2013 (+9)49.

[...]

A large majority of respondents in the euro area countries continue to support economic and monetary union and the majority has even increased (67%, +4 percentage points). Despite a slight dip, a majority of respondents in the non-euro area countries remain against economic and monetary union (57%, -1, versus 32%, -2).

In the Standard Eurobarometer survey of autumn 2013 (EB80), Cyprus was the only euro area country which did not have majority support for the euro. As a result of a nine percentage point increase in positive opinions in this survey, Cyprus now has a majority of respondents who support the euro (53% versus 44%, compared with 44% versus 52% in autumn 2013).

Consequently, an absolute majority of the respondents in the 18 euro area countries now support the euro, with scores ranging from 53% in Cyprus to 80% in Estonia (+4). Support for the euro has increased very strongly in Latvia50 (68%, +15 versus autumn 2013 and +25 versus spring 2013). Other than in Cyprus, this support has also increased strongly in Portugal (59%, +9) and Greece (69%, +7).

Det er enda større flertall som støtter felles utenrikspolitikk og felles forsvars- og sikkerhetspolitikk. (Side 137 og utover.) Selv om tilliten til hver enkelt av EUs institusjoner er rekordlav, er det til og med litt fler som sier seg fornøyd med måten demokratiet i EU fungerer på enn som sier seg misfornøyd. (Side 127-128.)

Det er sjarmerende med folk som sitter utenfor hele greia og bekymrer seg over mangelen på demokrati, men det kunne muligens være verdt bryderiet å sjekke hva meningsmålinger blant dem det angår sier.

Din verden, hvor bankene tjente penger på å ettergi halve lånene til Hellas og befolkningen absolutt ikke vil ha euroen, skiller seg vesentlig fra den virkeligheten jeg mener å se.Sist redigert:Venstrepopulistene er i rask tilbakegang, også i Spania:

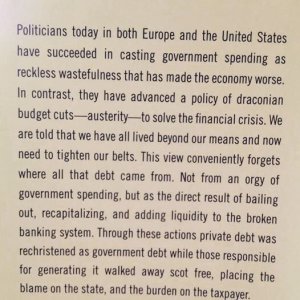

Podemos fortsetter å tape terreng - DN.noAh, men den greske gjelden oppsto som "an orgy of govenment spending" og "reckless wastefulness". Det finansierte en gigantisk boom i årene 2001-2009, alt sammen for lånte penger. Bankenes store feil var at de trodde det var trygt å låne ut penger til den greske staten, euromedlem og greier som den er. Når den greske staten ikke kunne eller ville betale tilbake i 2010 fikk bankene et problem. Utfallet varierte fra bank til bank, men mellom 50 og 75 % av gjelden måtte ettergis. Resten av den greske gjelden overtok de andre europeiske skattebetalerne ansvaret for. I år ville gjerne grekerne at de andre europeiske skattebetalerne skulle ettergi den gjelden også, og at de andre europeiske skattebetalerne heller ikke skulle stille noen krav til den greske balansen mellom inntekter og utgifter slik at grekene kunne fortsette å finansiere offentlige utgifter med å ta opp nye lån, som i sin tur måtte ettergis av de andre europeiske skattebetalerne om noen år. Svaret på den planen var vel ganske tydelig.

Det blir helt feil å starte historiefortellingen i 2010. Gresk gjeld er regningen for gammel statlig moro. Det ble først et privat problem når staten ikke overholdt sin del av avtalen.Sist redigert:HHardingfele

Gjest

Enda en pessimist som synes å se break-up i horisonten. God analyse.

The negotiations leading to the Greek agreement also destroyed the constructive ambiguity created by the Maastricht Treaty by making it absolutely clear that Germany is prepared to amputate and obliterate one of its members rather than make concessions. Germany appears to believe that the single currency ought to be a fixed exchange-rate regime or not exist at all in its current form, even if this means abandoning the underlying project of political integration that it was always meant to serve.

Finally, and perhaps most importantly, Germany signaled to France that it was prepared to go ahead alone and take a clear contradictory stand on a critical political issue.

This forceful attitude and the several taboos it broke reveal that the currency union that Germany wants is probably fundamentally incompatible with the one that the French elite can sell and the French public can subscribe to. The choice will soon be whether Germany can build the euro it wants with France or whether the common currency falls apart.

...

Regardless of what happens in Greece now, the July 13 agreement has made the prospect of a future euro breakup far more likely. The question is whether it will take the form of an orderly departure by Germany or a prolonged and economically more destructive exit by France and the south of Europe.

http://www.nytimes.com/2015/07/28/o...-could-destroy-the-euro.html?ref=opinion&_r=0

Fyren kan være professor så mye han vil, han tar like fullt feil når han velger forklaring etter den korte tiden av historien som passer hans bilde. Kjenner det er mindre og mindre inspirerende å diskutere Hellas når de samme vindmøllene virvles opp hele tiden.Mark Blyth er professor i økonomi ved Brown University og forfatter av boken "Austerity". Hans korte oppsummering:

En tysk euro-exit og retur til D-mark er det vel bare de tyske nynazistene som går inn for, så det kan du glemme. En euro uten Tyskland vil heller ikke ha noen kredibilitet. Kursen vil øyeblikkelig falle til noe i retning av der pesetas, lire og drakmer pleide å holde til. Det er også på tide at Tyskland opptrer med den tyngden størrelsen tilsier også når ikke alle andre er enige. Det får være grenser for hvor lenge et land skal be om unnskyldning for et tidligere bandittregimes forbrytelser, selv om en fransk pratmaker anser det som "tabu" at Tyskland skal ha et synspunkt på hvor pengene deres skal brukes.Finally, and perhaps most importantly, Germany signaled to France that it was prepared to go ahead alone and take a clear contradictory stand on a critical political issue.

This forceful attitude and the several taboos it broke reveal that the currency union that Germany wants is probably fundamentally incompatible with the one that the French elite can sell and the French public can subscribe to. The choice will soon be whether Germany can build the euro it wants with France or whether the common currency falls apart.

En bedre analyse er at forhandlingene styrket Hollandes og Tusks rolle som "dealmakers". Hollande kan (og vil) bruke den økte kredibiliteten til å argumentere for at EUs institusjoner må styrkes for å unngå lignende kriser i fremtiden. Dvs å ta konkrete skritt mot en reell økonomisk union. Tyskland satte ned foten denne gangen, men det er Hollande og Tusk som er de egentlige vinnerne målt i politisk innflytelse.- Ble medlem

- 19.09.2014

- Innlegg

- 23.414

- Antall liker

- 16.300

Ang professorer og slikt: Det mest siterte og innflytelsesrike paperet på hvor farlig det er å ha høy gjeldsbyrde i forhold til BNP har sannsynligvis gal konklusjon - eller i det minste betydelig svakere statistisk grunnlag for konklusjonen, og feilen kommer av at de summerte feil antall rader i Excel. Ble oppdaget av en britisk student om jeg ikke husker feil...

Mitt inntrykk av det sitatet er at han blander sammen trekk fra oppløpet til den amerikanske finanskrisen med deler av EUs politikk etterpå for å komme frem til den konklusjonen han vil ha.

Fyren kan være professor så mye han vil, han tar like fullt feil når han velger forklaring etter den korte tiden av historien som passer hans bilde. Kjenner det er mindre og mindre inspirerende å diskutere Hellas når de samme vindmøllene virvles opp hele tiden.Mark Blyth er professor i økonomi ved Brown University og forfatter av boken "Austerity". Hans korte oppsummering:

Ja, finanskrisen i USA ble utløst av uansvarlig risikotaking i private banker som ble ansett som "too large to fail" og myndighetene så seg nødt til å overta mye av gjelden. Helt uakseptabelt, selvsagt, når banksjefene hadde innkassert fete bonuser i årevis for hasardiøs risikotaking og skattebetalerne måtte ta regningen når det smalt. Deretter har USA ført en løs finans- og pengepolitikk, såpass løs at debattspaltene har vært breddfulle av teorier om hvordan underskuddsbudsjettene og the Feds pengetrykking kom til å føre til hyperinflasjon og at gull var det eneste sikre tilfluktssted for verdiene. Republikanerne har ønsket å stramme inn hele veien, men det er nå engang ikke de som har hatt presidenten i denne perioden. Vel, USAs økonomi har kommet seg langsomt på fote igjen, siste måneds arbeidsledighetstall var de beste siden 1971, og gullprisen har falt som en stein, så noe har visst vært gjort riktig i årene etter at det smalt.

Derimot har EU ført en i overkant stram penge- og finanspolitikk i årene etter finanskrisen. Den har gjort at innhentingen har tatt lengre tid enn nødvendig. En av grunnene til at det ble slik er mangelen på en felles finanspolitikk. Da blir pengepolitikken (rente og valutakurs) eneste styringsmekanisme, og som vi har sett er en pengepolitikk som passer for Tyskland og Finland mindre passende for Hellas og Italia.

På den andre siden er årsakene til den europeiske krisen litt mer varierte enn hva sitatet gir inntrykk av. Noe er ren spillover fra USA, men det var fort unnagjort. De forskjellige kriselandene (PIIGS) har i stor grad kommet dit de er av litt ulike årsaker. I Spania var økonomien altfor avhengig av byggebransjen og bygging av stadig nye ferieboliger. På Island hadde bankene fått vokse seg altfor store i en hodeløs jakt på markedsandeler inntil risikoeksponeringen til slutt ble mye større enn hva den islandske økonomien kunne tåle. Men de bankene fikk gå konkurs, tapene ble sanert og de mest hodeløse banksjefene ble satt i fengsel. I Irland overtok staten, dumt nok, en altfor stor andel av bankenes forpliktelser og gjorde omtrent det Hardingfeles avisutklipp kritiserer. Og i Hellas var det altså en massiv lånefinansiert offentlig pengebruk hvor store underskudd på statsbudsjettene ble finansiert gjennom stadig nye lån.

Kardinalfeilen i EU var at Tyskland selv brøt med stabilitetskravene ved å ha større underskudd på statsbudsjettet enn tillatt, og da tenkte alle andre at det ikke er så farlig om de gjør det heller. Så begynte offentlige låneopptak og budsjettunderskudd å vokse ut av kontroll. En sentralt plassert kilde beskrev det som at "paven begynte å drekke". Selv om USA kan slippe unna med denslags, er det ikke sånn at europeiske land kan skyve underskuddene foran seg på samme måte. (Dollaren er verdens "reservevaluta", mens euroen er det ikke i samme grad.) Nå er den paven tydeligvis tilbake på vannvogna - og takk for det.

Det blir like riktig eller galt som dette utklippet å kritisere myndighetene i EU og USA for altfor løssluppen pengebruk før krisen (f eks Hellas) og fortsatt løs økonomisk politikk etter krisen (f eks USA), og konkludere med at hyperinflasjon og dommedag er nær, investere i gull og hamstre hermetikk og ammunisjon (som amerikanske Tea Party-skrullinger gjør). Det er utrolig hva man kan komme frem til hvis man kan plukke sine fakta helt fritt og hoppe frem og tilbake mellom ulike land i resonnementet sitt.Sist redigert:Men altså, i EU (talking Tyskland og Frankrike) så var noe av de involverte bankene faktisk too big to fall. Og å gjøre det hele til en ren Hellaskrise, blir småsært. EU har en krise, og Hellas er ikke det eneste landet som er råka.

«So European banks’ asset footprints (loans and other assets) expanded massively throughout the first decade of the euro, especially into the European periphery. Indeed, according the Bank of International Settlements, by 2010 when the crisis hit, French banks held the equivalent of nearly 465 billion euros in so-called impaired periphery assets, while German banks had 493 billion on their books. Only a small part of those impaired assets were Greek, and here’s the rub: Greece made up two percent of the eurozone in 2010, and Greece’s revised budget deficit that year was 15 percent of the country’s GDP—that’s 0.3 percent of the eurozone’s economy. In other words, the Greek deficit was a rounding error, not a reason to panic. Unless, of course, the folks holding Greek debts, those big banks in the eurozone core, had, over the prior decade, grown to twice the size (in terms of assets) of—and with operational leverage ratios (assets divided by liabilities) twice as high as—their “too big to fail” American counterparts, which they had done. In such an over-levered world, if Greece defaulted, those banks would need to sell other similar sovereign assets to cover the losses. But all those sell contracts hitting the market at once would trigger a bank run throughout the bond markets of the eurozone that could wipe out core European banks»

https://www.foreignaffairs.com/articles/greece/2015-07-07/pain-athens

Også kunne vi ha snakket om hvordan lønningene i Tyskland er blitt holdt nede og dermed bidratt til det voldsomme Tyske overskuddet etc.

Ja, Hellas har et jævla problem med (den manglende) staten sin og bruken av penger, men det er ikke moren til all faenskap.

Tillegg: Og ingen jeg har lest sier at EUs problem er løst ved å løse Hellasproblemet (snevert forstått).

Tillegg II: Faen, mulig det har vært linket til før. (Kan dog leses igjen!)Sist redigert:- Ble medlem

- 13.10.2005

- Innlegg

- 21.457

- Antall liker

- 6.882

Er man veldig imot EU så er det EU som er problemet.

Er man veldig imot euroen så er det den som er problemet.

Har man veldig mye imot finansbransjen er det den som er problemet.

Har man veldig mye imot sosialister er det de som er problemet.

Har man veldig mye imot tyskere er det de som er problemet. -

Laster inn…

Diskusjonstråd Se tråd i gallerivisning

-

-

Laster inn…