Du ser ikke overskrifter som: Vindturbin i brann, hundretusener er blitt evakuert.

Det må bygges opp til 10.000 kjernekraftverk for å erstatte energi fra kun olje (gass og kull unntatt). Og det på en planet med et par hundre kjernekraftverk nå (det er flere reaktorer på de fleste verk, og litt over 400 reaktorer produserer strøm til salg).

Et intensivprogram for å bygge 10.000 kjernekraftverk over kort tid er nok ikke hva planeten trenger, om man ønsker å være risikoavers.

Føre-var-prinsippet fikk altså verdens luftfartsmyndigheter til å sette mange hundre fly på bakken, etter to flystyrt. Men atomkraft påstås det skal bli veldig trygt.

Da gjenstår bare å få tak i penger til atomkraft. Industrien har oppdaget at investorer ikke vil investere i atomkraft. Forskringsbransjen forsikrer ikke atomkraft. Folk vil ikke ha atomkraft i nærheten av hvor de bor. Hvor skal de 10.000 atomkraftverkene bygges?

Jeg anbefaler at fnysefråde tar en kikk på artikkelen "Nuclear Socialism" -- kanskje det er vaksine nok?

https://rmi.org/insight/nuclear-socialism/

Svaret på kritikken under er alltid: men nå skal vi klare å bygge dem billigere!!!

Les det som står, så kan vi ta en debatt. Dette handler om økonomi, ikke om følelser. Om man fortsatt går inn for atomkraft, etter å ha lest dette, er man enten ikke i stand til å tenke, eller regne, eller begge deler.

Amory Lovins, ved Rocky Mountain Institute. Det instituttet ikke vet om energiproduksjon er ikke verdt å vite.

Given Americans’ increasing anxiety over made-in-Washington socialism, it’s a wonder that the nuclear power industry has escaped scrutiny for so long. The federal government socializes the risk of investing in nuclear power while pri-vatizing profits. This same formula drove the frenzied speculation that cratered the housing and financial markets. What might it cause with nuclear power?

We got a taste three decades ago. Congress grew infatuated with the promises of nuclear promoters. It overrode the risk assessment of private capital markets, and expanded subsidies for nuclear projects to $0.08 per kilowatt-hour—often more than investors risked or than the power could be sold for. This seduced previously prudent utilities and regulators into a nuclear binge that Forbes in 1985 called “the largest managerial disaster in business history.”

Threefold cost overruns amounted to hundreds of billions of dollars. Three-fifths of the ordered plants were abandoned. Many others proved uncompetitive. Steep debt downgrades hit four in five nuclear utilities. Some went broke. Through 1978, 253 U.S. reactors were ordered (none since). Only 104 survive. Two-fifths of those have failed for a year or more at least once.

New nuclear plants, we’re assured, are different—novel enough to merit technology-demonstration subsidies, yet proven enough that investors can rest easy. They’re allegedly so much safer than deep-sea oil drilling that we needn’t fret, yet so risky that one major nuclear operator insured itself eleven times more against nuclear accidents’ consequences than its potential liability to the public. New reactors are supposedly so cheap they crush competitors, yet so costly they need subsidies of 100 percent or more.

That’s right: $0.04-$0.06 of new 2005-07 subsidies, plus $0.01-$0.04 of remaining old subsidies, brings total federal support for new nuclear plants, built by private utility companies, to $0.05-$0.10 for a kilowatt-hour worth $0.06. Some people are outraged that the federal government is subsidizing the new Chevrolet Volt, retailing at $41,000, with a tax credit of $7,500. Imagine if the tax credit were $50,000! If new reactors can produce competitive power, they don’t need subsidies; if not, they don’t deserve subsidies.

Yet nuclear subsidies to some of the world’s largest corporations have become shockingly large. A Maryland reactor’s developer reckoned just its requested federal loan guarantee would transfer $14.8 billion of net present value, comparable to its construction cost, from American taxpayers to the project’s 50/50 owners—Électricité de France (EDF), 84 percent owned by the French government, and a private utility 9.5 percent owned by EDF. The project’s builder, AREVA, is 93 percent owned by the French state, yet has been promised a $2 billion U.S. loan guarantee for a fuel plant competing with an American one. EDF just booked a billion-euro loss provision, mainly over the Maryland plant’s deteriorating prospects. AREVA’s construction fiascoes in Finland and France have “seriously shaken” confidence, says EDF’s ex-chairman, and four nations’ safety regulators have criticized the design. Meanwhile, the chairman of Exelon, the top U.S. nuclear operator, says cheap natural gas will postpone new nuclear plants for a decade or two. Slack electricity demand and unpriced carbon emissions further weaken the nuclear case. Markets would therefore charge a risk premium. But U.S. nuclear power evades market discipline—or did until October 8, 2010, when the Maryland promoter shelved the project because, for its $7.5 billion federal loan guarantee, it would have to have paid an “unworkable” $0.88 billion fee, or 11.6 percent, to cover the default risk to taxpayers.

Another $8.3 billion of the $18.5 billion nuclear loan guarantees authorized in 2007 was provisionally issued in February to two Georgia reactors. Taxpayers will be on the hook for about $100 per American family. To offset that risk, the Department of Energy proposed to charge a default fee that’s only a small fraction of the likely loss rate that the Congressional Budget Office and Government Accountability Office have estimated. In bankruptcy, taxpayers wouldn’t even recover before private lenders—not that there are any private lenders. The Treasury’s Federal Financing Bank, financed by new Treasury debt, would issue the DOE-guaranteed loan. Failure would cost taxpayers $8.2 billion net. The developer keeps any upside.

The Georgia project’s loan-guarantee default fee is much lower than the Maryland plant’s, partly because the Georgia developers have already shifted more of their remaining risks to ratepayers. Their project is 54 percent owned by municipal utilities and rural co-ops with access to cheaper financing than private utilities, including subsidized stimulus bonds. Some of these munis and co-ops signed 50-year contracts with the nuclear operators that would put them and their customers on the hook even for power not needed or wanted. In 1982-83, the analo-gously financed five-reactor WPPSS (“Whoops”) project in the Northwest defaulted on municipal bonds, vaporizing $3-$4 billion in today’s dollars.

Moreover, a few southeastern states now make utility customers finance new reactors in advance—often whatever they cost, whether they ever run, no questions asked, plus a return to the utilities for risks that they no longer bear.

This scraps all five bedrock principles of utility regulation: payment only for service delivered and only for used and useful assets; accountability for cost and prudence; return matching risk; and no commission able to bind its successors. Such laws re-create for nuclear power the same moral hazard that just shredded America’s financial sector.

With such juicy incentives, why won’t private investors finance reactors? In 2005-08, with the strongest subsidies, capital markets, and nuclear politics in history, why couldn’t 34 proposed reactors raise any private capital?

Because there’s no business case. As a recent study by Citibank U.K. is titled “New Nuclear—the Economics Say No.” That’s why central planners bought all 61 reactors now under construction worldwide. None were free-market transactions. Subsidies can’t reverse bleak fundamentals. A defibrillated corpse will jump but won’t revive.

American taxpayers already reimburse nuclear power developers for legal and regulatory delays. A unique law caps liability for accidents at a present value only one-third that of BP’s $20 billion trust fund for oil-spill costs; any bigger damages fall on citizens. Yet the competitive risks facing new reactors are uninsured, high, and escalating.

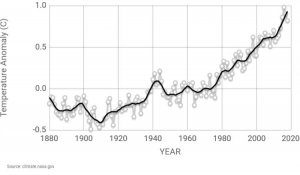

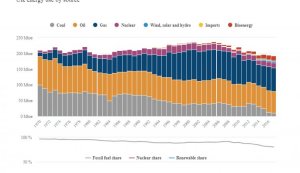

Since 2000, as nuclear power’s cost projections have more than tripled, its share of global electricity generation has fallen from 17 percent to 13 percent. That of cogeneration (making electricity together with useful heat in factories or buildings) and renewables (excluding big hydropower projects) rose from 13 percent to 18 percent.

These bite-sized, modular, quickly built projects—with financial risks, costs, and subsidies generally below nuclear’s and declining—now dominate global power investments. Last year, renewables (wind, water, solar, geothermal), excluding large hydroelectric dams, attracted $131 billion of private capital and added 52 billion watts. Global nuclear output fell for the past three years, capacity for two.

This market shift helps protect the climate. Renewables, cogeneration, and efficiency can displace 2 to 20 times more carbon per dollar, 20 to 40 times faster, than new nuclear power—saving trillions of dollars over decades and avoiding vast financial risks.

Still uncompetitive despite 60 years of handouts, nuclear developers clamor for ever greater subsidies. The White House, Senate, and House all propose expanded federal loan guarantees ($36 billion was the White House figure); developers demand at least $100 billion. The Clean Energy Deployment Administration endorsed by both houses of Congress could issue unlimited loan guarantees without congressional oversight. It would probably fund nuclear and renewable energy like the recipe for elephant-and-rabbit stew—one elephant, one rabbit.

Bureaucrats, not credit markets, would evaluate risks and pick winners. Taxpayers would become America’s main energy financiers and almost exclusive nuclear risk-takers. America’s once market-based electricity investments would work like China’s, Russia’s, and France’s nuclear command economies. This is bipartisan folly.

As nuclear subsidies spiral toward fiscal ruin, brave voices protest from a handful of think tanks: the Heritage Foundation, the Cato Institute, the George C. Marshall Institute, the American Enterprise Institute, the Competitive Enterprise Institute, the National Taxpayers Union, Taxpayers for Common Sense. Yet most congressional budget hawks—supposedly sages of circum-spection and defenders of free markets—urge more nuclear socialism.

Here’s a principled alternative: Reverse the energy subsidy arms-race. Don’t add subsidies; subtract them. Take markets seriously. Not just for nuclear and fossil fuels but for all so-called “clean” technologies, head toward zero energy subsidies, free enterprise, risk-based credit pricing, competition on merit, cheaper energy services, greater energy security, and dwindling deficits.

Who wouldn’t like that? Why don’t we find out?