Har du noen graf for elmotorer med energi fra kull og evt . hydro(vannkraft)?

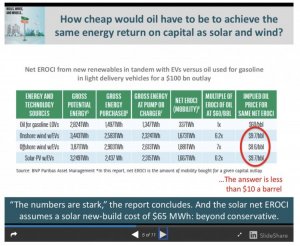

Du skal få link til hele rapporten, men spm ditt er irrelevant i lys av hva studien kikker på. Dette handler om hva man har igjen av nytte-energi til mobilitet etter en investering på USD100 milliarder.

Dette handler ikke om at en del elkjøretøy i dag får sin energi fra kullkraftverk/gasskraftverk. Vannkraft ser de ikke på, men kommer selvsagt også godt ut i forhold til konvertering til mobilitet. Selv om jeg kan forestille meg at det er rimeligere å installere solcelleanlegg/solkraftverk enn å bygge store vannkraftverk.

https://docfinder.bnpparibas-am.com/api/files/1094E5B9-2FAA-47A3-805D-EF65EAD09A7F

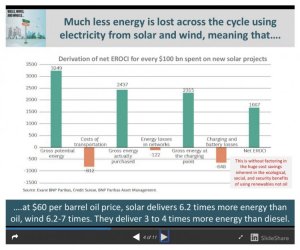

Sol/vind > elbil:

After accounting for energy losses over the transmission and distribution networks of 10%, we have 2,324TWh of gross energy available at the charging point.

Finally, after taking in to account the energy losses in charging the battery and converting the energy in the motor (~30%), we end up with 1,667TWh of useful mechanical energy from our $100bn outlay.

This means that the net energy available to do useful work at the wheels for a solar-powered EV is equivalent to 50% of the gross potential energy inherent in $100bn worth of new solar projects at a capital cost of $0.8bn/GW.

Dieselmotor:

For diesel, we again start with the gross potential energy that we would get if we were able to spend the full $100bn on crude oil (2,824TWh), and with no energy losses at the refinery this gives us a gross energy at the pump for diesel after factoring in the costs of refining, transporting, and taxing the oil of 1,497TWh.

After then taking in to account the energy losses in the diesel engine at our assumed thermal-efficiency rate of 35%, we finish with 524TWh of useful mechanical energy.

This means that the net energy available to do useful work at the wheels for a diesel-powered LDV is equivalent to only 19% of the gross potential energy inherent in $100bn worth of crude oil at $60/bbl.

Bensinmotor:

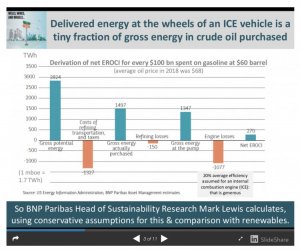

In terms of the breakdown of expenditure, we work backwards from the cost to the end-consumer at the pump. In other words, in order to deliver the gasoline or diesel to the pump, we ask how much of our notional $100bn we could spend on the crude oil itself, and how much would have to be spent to cover the costs of refining and transporting the oil to the end user, while also allowing for the taxes payable across the value chain. Looking again at the EIA’s webpage on prices at the pump for gasoline and diesel, we derive the breakdown shown in Figure 13.24

In other words, we assume that of the $100bn outlay, only $53bn is spend on the crude oil itself, while the rest is accounted for by the various other costs that need to be covered to get the oil to the end- consumer as either gasoline or diesel.

In terms of the energy losses, we assume that gasoline has 10% less energy than crude oil, but that diesel has the same energy content as crude oil. This means that in terms of the gross energy at the pump, there is 10% less available for a gasoline engine than for a diesel engine.

Finally, we then have to account for the energy losses in the combustion process in gasoline-ICE and diesel engines. For gasoline engines, we assume a thermal-efficiency rate of 20%, while for diesel engines we assume a thermal-efficiency rate of 35%. Of course, these are stylized assumptions as in reality efficiency rates will vary between different engines, but we think these are reasonable estimates for the generic efficiency of the gasoline engine and diesel engines that comprise the world’s existing vehicle fleet today.25

What this means is that on our calculations 80% of the gross energy available at the pump as gasoline is lost in a gasoline engine and so does not provide useful or mechanical energy at the wheels, while for diesel on our numbers 65% of the gross energy at the pump is lost.

Figure 14 and Figure 15 then show the full three-step approach of our analysis for gasoline and diesel respectively that we use to derive our net-EROCI numbers. For gasoline, we start with the gross potential energy that we would get if we were able to spend the full $100bn on crude oil. At $60/bbl this would equate to 1.67bn barrels of oil, which equates to 2,824TWh.

However, we then have to factor in the costs of refining, transporting, and taxing the oil, and on our assumption that these costs will take up 47% of the total outlay, this leaves us with 53% of the gross potential energy as the gross energy actually purchased. This would equate to 883m barrels of oil, which in turn equates to 1,497TWh.

After accounting for the energy losses in refining gasoline, we have 1,347TWh of gross energy available at the pump, and then after taking in to account the energy losses in the gasoline-ICE, we end up with 270TWh of useful energy.

This means that the net energy available to do useful work at the wheels for an LDV with a gasoline- powered ICE is equivalent to only 10% of the gross potential energy inherent in $100bn worth of crude oil at $60/bbl.