Noen få år tilbake fikk instrumentalistene lov til å herje med Vestens økonomi - i bakkant av finanskrisen var løsningen ikke å stimulere til vekst, men å spare seg til ny økonomisk oppblomstring. Mange kritiserte dette, bl.a. Krugman, som lanserte begrepet "confidence fairy."

Tanken var nemlig at man som en konsekvens av store nedskjæringer ville disiplinere folket (og økonomien) og på den måten gjenreise tillit til økonomiske relasjoner, som ville bli langt sikrere tuftet. Med Krugmans ord skulle "tillitsféen komme og drysse tillit over alle, og så ville økonomien være bra igjen."

Krugman mente at når økonomien ikke går godt, må myndighetene inn og stimulere vha arbeidsmarkedstiltak og støtte. Men hans kritikere, som fikk råde grunnen, mente at det var feil, og at det var innstramming som var løsningen. Nå er det full krise rundt omkring som et resultat av det, og i UK går Osborne fra skanse til skanse mens han desperat prøver å forklare at bedringen er like om hjørnet.

I stedet for å stimulere til sysselsetting gjennom tiltak, ga man pengene til finansindustrien, slik at den kunne opprettholde sin absurde livsstil. Hvem vet, kanskje er det en bakenforliggende plan her om å reise befolkningen mot de økonomiske elitene, vanskelig å se andre målsetninger som er rasjonelle i alt rotet.

Krugman har skrevet om det faktum at man nå endelig har innsett at nedskjæringer ikke var løsningen.

April 26, 2012

Death of a Fairy Tale

By PAUL KRUGMAN

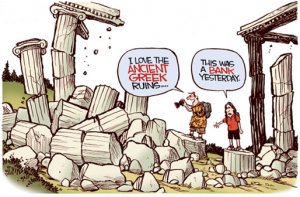

This was the month the confidence fairy died.

For the past two years most policy makers in Europe and many politicians and pundits in America have been in thrall to a destructive economic doctrine. According to this doctrine, governments should respond to a severely depressed economy not the way the textbooks say they should by spending more to offset falling private demand but with fiscal austerity, slashing spending in an effort to balance their budgets.

Critics warned from the beginning that austerity in the face of depression would only make that depression worse. But the austerians insisted that the reverse would happen. Why? Confidence! Confidence-inspiring policies will foster and not hamper economic recovery, declared Jean-Claude Trichet, the former president of the European Central Bank a claim echoed by Republicans in Congress here. Or as I put it way back when, the idea was that the confidence fairy would come in and reward policy makers for their fiscal virtue.

The good news is that many influential people are finally admitting that the confidence fairy was a myth. The bad news is that despite this admission there seems to be little prospect of a near-term course change either in Europe or here in America, where we never fully embraced the doctrine, but have, nonetheless, had de facto austerity in the form of huge spending and employment cuts at the state and local level.

So, about that doctrine: appeals to the wonders of confidence are something Herbert Hoover would have found completely familiar and faith in the confidence fairy has worked out about as well for modern Europe as it did for Hoovers America. All around Europes periphery, from Spain to Latvia, austerity policies have produced Depression-level slumps and Depression-level unemployment; the confidence fairy is nowhere to be seen, not even in Britain, whose turn to austerity two years ago was greeted with loud hosannas by policy elites on both sides of the Atlantic.

None of this should come as news, since the failure of austerity policies to deliver as promised has long been obvious. Yet European leaders spent years in denial, insisting that their policies would start working any day now, and celebrating supposed triumphs on the flimsiest of evidence. Notably, the long-suffering (literally) Irish have been hailed as a success story not once but twice, in early 2010 and again in the fall of 2011. Each time the supposed success turned out to be a mirage; three years into its austerity program, Ireland has yet to show any sign of real recovery from a slump that has driven the unemployment rate to almost 15 percent.

However, something has changed in the past few weeks. Several events the collapse of the Dutch government over proposed austerity measures, the strong showing of the vaguely anti-austerity François Hollande in the first round of Frances presidential election, and an economic report showing that Britain is doing worse in the current slump than it did in the 1930s seem to have finally broken through the wall of denial. Suddenly, everyone is admitting that austerity isnt working.

The question now is what theyre going to do about it. And the answer, I fear, is: not much.

For one thing, while the austerians seem to have given up on hope, they havent given up on fear that is, on the claim that if we dont slash spending, even in a depressed economy, well turn into Greece, with sky-high borrowing costs.

Now, claims that only austerity can pacify bond markets have proved every bit as wrong as claims that the confidence fairy will bring prosperity. Almost three years have passed since The Wall Street Journal breathlessly warned that the attack of the bond vigilantes on U.S. debt had begun; not only have borrowing costs remained low, theyve actually fallen by half. Japan has faced dire warnings about its debt for more than a decade; as of this week, it could borrow long term at an interest rate of less than 1 percent.

And serious analysts now argue that fiscal austerity in a depressed economy is probably self-defeating: by shrinking the economy and hurting long-term revenue, austerity probably makes the debt outlook worse rather than better.

But while the confidence fairy appears to be well and truly buried, deficit scare stories remain popular. Indeed, defenders of British policies dismiss any call for a rethinking of these policies, despite their evident failure to deliver, on the grounds that any relaxation of austerity would cause borrowing costs to soar.

So were now living in a world of zombie economic policies policies that should have been killed by the evidence that all of their premises are wrong, but which keep shambling along nonetheless. And its anyones guess when this reign of error will end.